Richard Drury

By Peter Bourbeau & Margaret Vitrano

Cyclical Growers Take Leadership Turn

Market Overview

Volatility rose in the third quarter as a series of weak employment reports caused a growth scare that sent parts of the U.S. equity market into a brief correction. Lifted by the Federal Reserve’s ambitious 50 basis point interest rate cut, stocks rallied to finish the period with broad gains. The S&P 500 Index (SP500), (SPX) rose 5.89% while the small cap Russell 2000 Index (RTY) jumped 9.27% as equity leadership broadened beyond the Magnificent Seven.

Profit taking among mega caps and early indications of a potential market rotation caused growth stocks to trail value for the quarter. The benchmark Russell 1000 Growth Index advanced 3.19%, underperforming the Russell 1000 Value Index (+9.43%) by over 620 bps.

For most of 2023 and the first half of 2024, momentum-oriented and AI-driven growth stocks led the market. In these environments, the ClearBridge Large Cap Growth Strategy saw greater participation from our select bucket of higher-growth companies. In more balanced markets, like the one that characterized the third quarter, we see broader contributions, with performance driven more by our stable and cyclical growth holdings.

The Strategy outperformed the benchmark for the period, supported by this emphasis on diversification. On a sector level, performance was led by the health care, communication services and industrials sectors. On a stock level, the Strategy received meaningful contributions from Meta Platforms (META), UnitedHealth Group (UNH) and Equinix (EQIX), from our stable bucket of investments, and PayPal (PYPL), Sherwin-Williams (SHW) and RTX in the cyclical bucket.

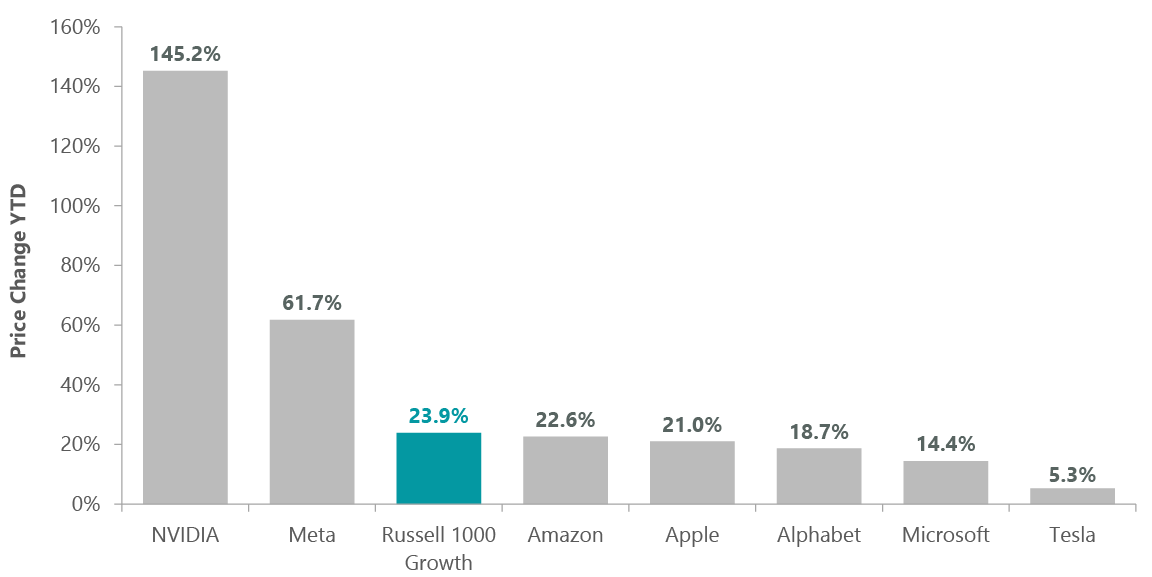

With the Strategy benchmarked against a historically concentrated Russell 1000 Growth Index, one of our priorities is managing the portfolio’s mega cap exposure. Since we cannot own the entire Magnificent Seven at market weight, we must evaluate which companies are best positioned to outperform over the next three to five years and, for the past year, we have done an effective job in choosing which companies to overweight and underweight. Magnificent Seven performance has continued to diverge in 2024, making it even more important to deliver solid stock selection both among this group and across the rest of the growth market.

Exhibit 1: The Divergent 7

As of Sept. 30, 2024. Source: ClearBridge Investments, FactSet, Russell.

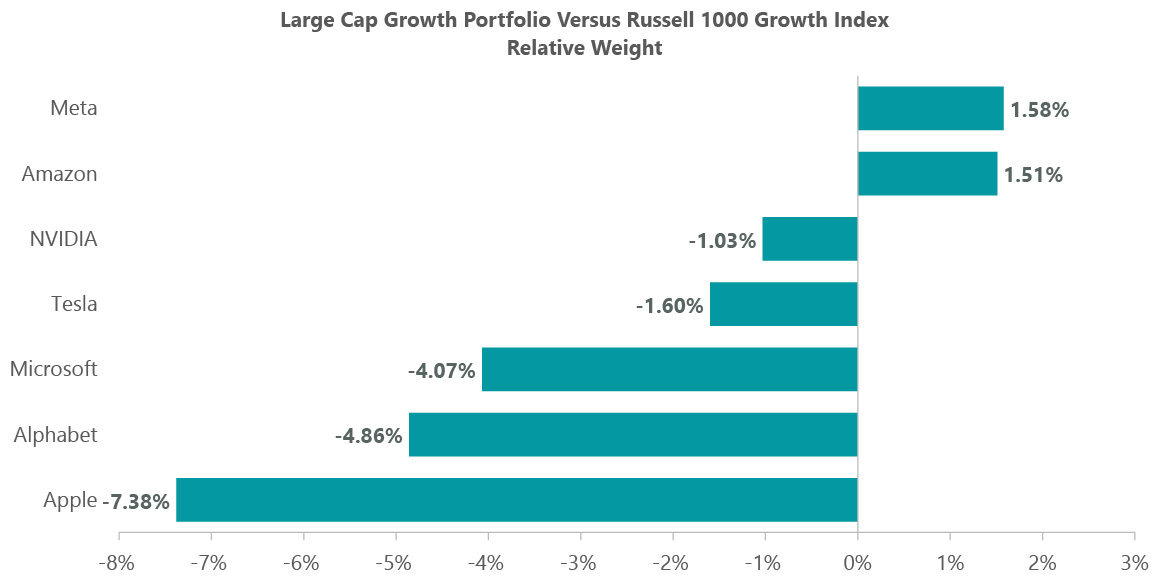

As shown in Exhibit 2, the Strategy is meaningfully underweight the Magnificent Seven compared to our benchmark. This is by intention, both to prudently manage risk among a small but strong-performing cohort of growth companies as well as to take full advantage of the more attractive opportunities that our fundamental research uncovers.

Exhibit 2: Managing Mega Cap Exposure

As of Sept. 30, 2024. Source: ClearBridge Investments, FactSet.

Portfolio Positioning

One of the keys to recent results and to delivering consistent, long-term performance through market cycles is how we think about risk. During our investment diligence process and ongoing work on portfolio holdings, we focus attention on how our thesis could be wrong and what the implications for stock valuation would be under these scenarios. Being sensitive to valuation is at the core of our portfolio construction efforts and prevents us from owning a particular stock or theme where we are not comfortable with the price. Accenture (ACN), a new addition in the second quarter, is a good example. The stock was on our whiteboard for several years, and we remained patient until volatility created an attractive entry point. We further added to the position in the third quarter.

Similarly, we took advantage of a business reset at Starbucks (SBUX) in the third quarter to initiate a position in the global coffee retailer. A confluence of factors, including degraded store-level operations and long consumer wait times, consumer fatigue with high prices and weakening engagement among occasional Starbucks customers has led to declining U.S. same-store sales growth. While the path ahead will likely require reinvestment back into the business, there are many merits to Starbucks’ business including its strong brand name and category leading market position. In response to recent challenges, Starbucks has appointed change-agent CEO Brian Niccol, who we know from the Strategy’s ownership of Chipotle Mexican Grill (CMG) during its turnaround. Niccol has a successful track record of investing in product innovation and fixing execution issues, which we believe are the primary challenges facing Starbucks today. Starbucks represents the kind of successful playbook we have executed on historically – focusing on high-quality businesses and brands while being disciplined around the entry point into investments with attractive risk-reward opportunities.

On the sell side, we remain disciplined in revisiting our thesis for each underperformer and determining whether we still have high confidence in the company. This analysis led us to exit three positions during the quarter that we had been gradually trimming.

Estee Lauder (EL), a well-known global cosmetics and skin care brand in consumer staples, was purchased as a cyclical turnaround investment in late 2022. At that time, the company had already reduced its earnings outlook due to softness in its high-margin skincare business, primarily driven by bloated inventory in the Asia travel retail distribution channel. Although we appreciated that operating margin improvement was going to be a journey, weak results in China have persisted longer and been more pronounced than we appreciated. Estee Lauder’s outlook for fiscal year 2025 points to another year of challenges in its end markets. While we still believe Estee Lauder’s long-term profitability is underappreciated, we fully exited the position in the quarter due to lack of visibility on fundamental improvement to the business.

Workflow and collaboration software maker Atlassian (TEAM) was also sold as it continues to experience seat-based spending pressure from end-customers rationalizing headcount and re-prioritizing information technology budgets. The company is also executing upon an on-premise to cloud migration, which has introduced incremental volatility to operating results.

Lastly, we sold our position in tier 1 automotive parts supplier Aptiv (APTV). Part of our original investment thesis for Aptiv was that the company should garner a premium multiple versus competitors as its product portfolio was well-positioned to take share as auto production shifted toward electric vehicles. However, weak global auto demand and slowing mix shift toward EVs has pressured Aptiv’s business and the company is capturing share at a slower rate than we anticipated. While Aptiv has executed well on profitability and trades at a cheap valuation, we do not foresee the same level of multiple expansion as the company’s growth relative to the market remains weak.

This focus on consistency also guides our regular trimming of strong performers to manage stock-specific and overall portfolio risk. The quarter saw us continue to trim Nvidia (NVDA), reducing the GPU chipmaker from an active weight in the portfolio to an underweight versus the benchmark. We continue to believe in Nvidia’s 10-year trajectory as hyperscaler and enterprise customers invest in GPU architecture. However, we have reduced our Nvidia position as its valuation now more fully reflects the company’s robust growth path and as estimates have risen to levels that require a very steep growth trajectory to drive further stock appreciation.

Outlook

Our focus remains on managing the Strategy for a wide range of possible outcomes. We do this by building some ballast into the portfolio through the ownership of more defensive companies like insurance broker Marsh & McLennan (MMC), aerospace and defense contractor RTX and diversified utility NextEra Energy (NEENEE). We view owning these companies as akin to buying an insurance policy; there is a cost to the insurance, as they are likely to trail in momentum markets, but in a market selloff this insurance should pay off in the form of better downside capture.

Volatility and variance are high right now as markets seek to price in several potential presidential election outcomes and gauge the pace of future rate cuts. We have said previously that monetary easing should act to stabilize equities as economic growth slows and the late-cycle expansion seeks its next catalyst. Whether growth reaccelerates or recession risk increases, we feel comfortable with our portfolio construction. If the former scenario occurs, our cyclical exposure should be beneficial while, in the latter, we have confidence that our stable and select names can generate above-market organic growth.

Portfolio Highlights

The ClearBridge Large Cap Growth Strategy outperformed its Russell 1000 Growth Index benchmark in the third quarter. On an absolute basis, the Strategy delivered positive contributions across seven of the 10 sectors in which it was invested (out of 11 sectors total). The primary contributors to performance were the health care, financials and industrials sectors while the IT and consumer discretionary sectors were the main detractors.

Relative to the benchmark, overall stock selection and sector allocation contributed to performance. In particular, stock selection in the health care and communication services sectors were the primary drivers of results. Overweights to industrials, utilities, financials and real estate as well as an underweight to IT were also beneficial. Conversely, stock selection in the consumer discretionary and IT sectors detracted from performance.

On an individual stock basis, the leading absolute contributors to performance were Meta Platforms, Apple, UnitedHealth Group, Sherwin-Williams and PayPal. The primary detractors were ASML, Amazon.com (AMZN), Microsoft (MSFT), Nvidia and Adobe (ADBE).

Peter Bourbeau, Managing Director, Portfolio Manager

Margaret Vitrano, Managing Director, Portfolio Manager

|

Past performance is no guarantee of future results. Copyright © 2024 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance source: Internal. Benchmark source: Russell Investments. Frank Russell Company (“Russell”) is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and/or Russell ratings or underlying data and no party may rely on any Russell Indexes and/or Russell ratings and/or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication. Performance source: Internal. Benchmark source: Standard & Poor’s. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.